Financial planning has always been about preparing for the future, but the future is more unpredictable than ever. The dynamic nature of global markets, unpredictable geopolitical events, and rapid technological advancements necessitate a shift towards adaptive strategies. This unpredictability can make financial decision-making challenging and fraught with risk.

However, acknowledging and understanding the nature of uncertainty is the first step towards managing it effectively. Recognizing that perfect decisions are rare and that adaptability is crucial allows you to approach planning with a mindset geared towards resilience and flexibility.

The Need for Adaptive Financial Planning

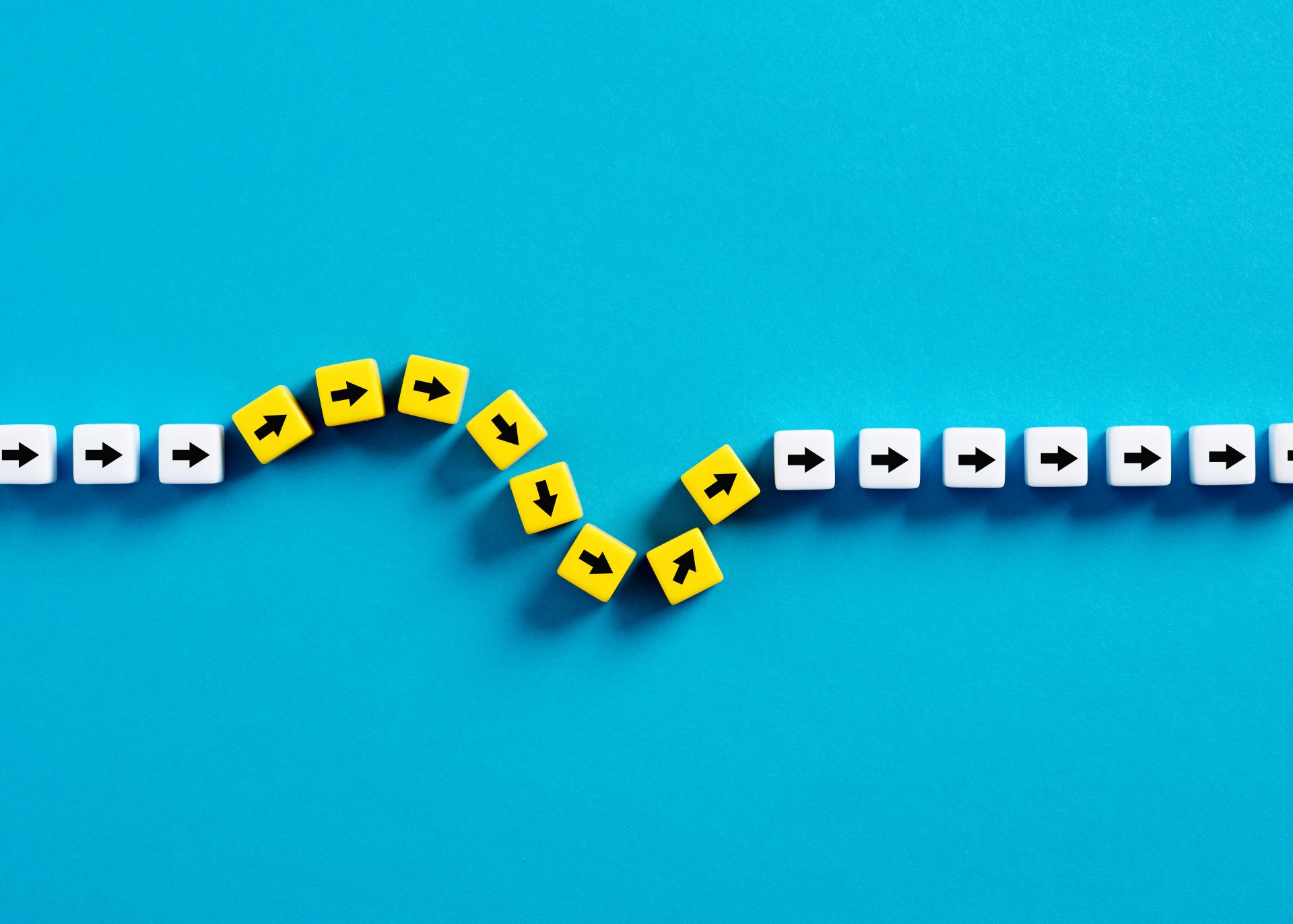

In an environment where change is constant, static plans that do not account for unexpected shifts can leave clients vulnerable. Adaptive financial planning, on the other hand, is designed to be flexible and responsive to changing conditions. Adaptive planning involves:

Continuous Monitoring and Review: Regularly updating financial plans to reflect the latest market conditions, economic indicators, and client circumstances.

Scenario Analysis: Developing multiple scenarios and contingency plans to prepare for a range of possible futures.

Careful Asset Allocation: Adjusting investment portfolios with market movements and emerging opportunities if necessary.

Risk Management: Implementing robust risk management strategies to protect against potential losses and unforeseen events.

Flexibility, Resilience, and Innovation

To thrive in an uncertain environment, Wealth Advisors cultivate a mindset of flexibility, resilience, and innovation.

Flexibility involves being open to change and ready to adapt plans as new information becomes available. This means not being overly committed to a single strategy but rather being willing to pivot when necessary. It also involves encouraging clients to remain flexible and prepared for adjustments in their financial plans.

Resilience is the ability to withstand and recover from setbacks. In financial planning, this means building robust strategies that can endure market downturns and economic shocks. It also involves helping clients build their financial resilience by promoting diversified investments and prudent savings habits.

Innovation is about finding creative solutions to emerging challenges. This could involve leveraging new technologies and data analytics to gain deeper insights and make more informed decisions. It also means staying ahead of trends and continuously seeking ways to improve financial planning processes and outcomes.

Capitalizing on Opportunities

While uncertainty presents challenges, it also creates opportunities. Market volatility can lead to attractive investment opportunities for those prepared to act quickly. By staying adaptable and innovative, your Wealth Advisor can turn uncertainty into an advantage.

Enhancing Client Outcomes

Ultimately, we want to deliver superior outcomes for clients. This means not only protecting their assets but also helping them grow their wealth and achieve their financial goals despite the uncertainties.

At Biondo Investment Advisors, we integrate adaptive financial planning approaches and foster a proactive mindset to navigate the complexities of the modern financial environment. By embracing flexibility, resilience, and innovation, we can provide clients with the confidence and peace of mind that their financial future is in good hands.