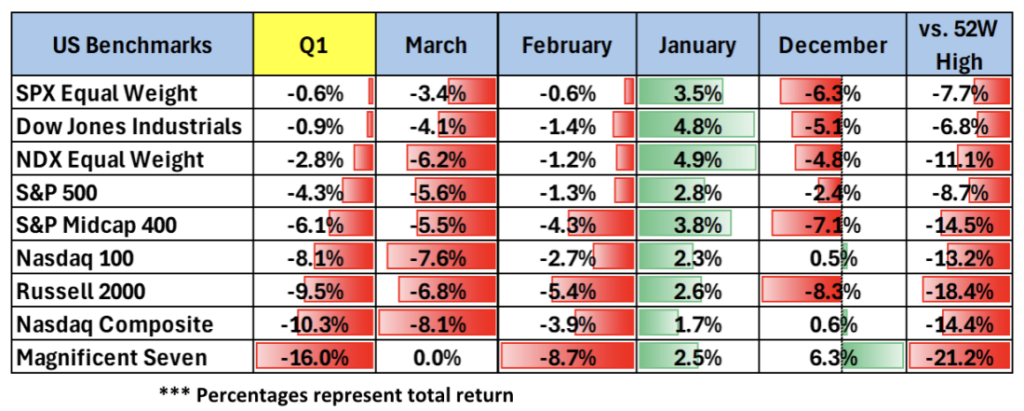

The first quarter of 2025 brought a surge in market volatility as new tariff announcements and renewed inflation risks disrupted what began as a cautiously optimistic year. US equity benchmarks posted their worst quarter since 2022 – the S&P 500 dropped 4.3%, the Nasdaq Composite tumbled 10.3% amid a tech selloff, and the Russell 2000 fell 9.5%. The Dow Jones Industrial Average held relatively flat, losing just 0.9%.

Sector performance diverged sharply – Energy gained 10.6%, Healthcare rose 5.6%, while Technology and Consumer Discretionary each plummeted over 13%. International markets held firmer: the MSCI ACWI ex-US Index climbed 5.2%, buoyed by a weaker dollar and stronger global demand. Meanwhile, bonds offered a defensive refuge, with the Bloomberg US Aggregate Bond Index rising 2.8% as investors rotated into high-quality fixed income amid rising uncertainty.

While inflation pressures and sectoral divergences shaped the broader Q1 downturn, the underlying driver of volatility—escalating trade tensions—accelerated meaningfully with the Trump administration’s tariff announcements in early April. On April 2, President Trump declared “Liberation Day,” introducing a 10% baseline tariff on all imports, effective April 5. Additionally, higher “reciprocal” tariffs were announced for 57 countries, based on trade deficits and perceived unfair practices.

These elevated tariffs were then suspended for 90 days for all countries except China, which now faces a cumulative tariff rate of 145% on its exports to the US. China responded by increasing tariffs on US goods to 125%, escalating the trade tensions. The situation has caused significant market volatility and uncertainty, with tech stocks experiencing sharp fluctuations due to temporary exemptions on certain electronics, such as smartphones and laptops. Commerce Secretary Howard Lutnick indicated that these exemptions are temporary and subject to change, adding to the uncertainty.

During the first quarter, inflation appeared to be moderating, giving hope that the Federal Reserve might begin easing later this year. But the new tariffs have altered the landscape. Headline CPI was relatively tame, and core inflation was trending down from its 2022 highs, but that has changed now. Analysts now expect the cost increases to reverse some of that progress, potentially adding 1-2 percentage points to inflation by year-end. Forward inflation expectations are rising across both consumer surveys and bond markets.

This development places the Fed in a precarious position. While policymakers had been signaling the possibility of rate cuts in late 2025, the inflationary jolt from tariffs may delay that path. The Fed held its benchmark rate steady at 4.25%–4.50% through Q1, and officials are now forced to balance the risk of economic slowing against the possibility of reaccelerating inflation. It’s unclear whether monetary policy alone can counteract tariff-driven price pressures, especially if global supply chains remain constrained.

Recession odds have risen accordingly. Though the US labor market remained solid in Q1—adding 228,000 jobs in March and keeping unemployment at 4.2%—consumer spending trends began to weaken. While January retail sales were strong, momentum faded through February and March. The personal savings rate rose to 4.6%, indicating that households are becoming more cautious. Discretionary spending categories like apparel, home goods, and dining saw softening. Big-ticket items—especially those requiring financing—have slowed as borrowing costs remain high and confidence wanes. Elevated interest rates, though justified as an inflation-fighting tool, continue to weigh on mortgage demand, auto loans, and consumer credit.

Corporations, particularly in import-heavy sectors like technology, apparel, and autos, are already signaling margin pressure. US automakers are grappling with rising component costs and inventory shortages, while manufacturers are stockpiling raw materials like copper and steel, driving up prices further. Oil markets reacted sharply on fears that tariffs would sap global demand. While lower energy prices could help consumers, they also threaten US shale producers, many of whom require higher breakeven prices to remain profitable.

Looking forward, several critical uncertainties will drive investor sentiment. Will trade negotiations cool tensions, or will retaliatory measures escalate? Can the Fed thread the needle between growth and inflation? Will consumers maintain spending momentum under rising price pressures? Until these questions gain clarity, markets are likely to remain volatile and reactive to incremental data releases and policy updates. The speculative excesses of 2023–2024 have largely been wrung out, with valuations in high-flying sectors like tech now returning to more grounded levels. This reset may eventually offer a firmer foundation for future gains—but for now, risk appetite remains muted, and markets are in “prove it” mode.

We continue to advocate for a balanced approach in portfolios. Diversification across asset classes and a focus on high-quality assets are critical in navigating an environment with rising macro risk and policy uncertainty. Maintaining flexibility and discipline will be key as opportunities and challenges evolve in real time.

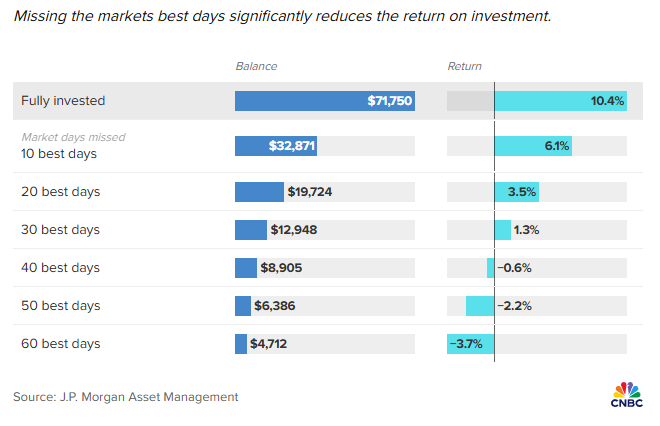

Resisting the urge to sell during downturns is critical to long-term returns. Over the past 20 years, seven of the market’s 10 best days occurred within just two weeks of the 10 worst days. History shows that major rebounds often follow sharp pullbacks—a trend clearly visible during the Covid crisis in 2020 and relevant again today. For example, a $10,000 investment in the S&P 500 held from 2005 through 2024 would have grown to $71,750. However, missing just the 10 best days would cut that total by more than half to $32,871. Missing the 60 best days would yield a negative return, leaving the investor with less than they started with.

This underscores the cost of panic-selling. Volatility, while uncomfortable, often precedes recovery. Behavioral finance reminds us that investors are wired to flee from danger, yet the market has recovered from every major crisis—wars, recessions, pandemics—and eventually pushed to new highs. The S&P 500 recently hit 6,000 in late 2024, a reminder that long-term trends often reassert themselves despite near-term noise.

It is during periods like this—where uncertainty is high and headlines are alarming—that sticking to a thoughtful long-term financial plan becomes most important. Market pullbacks can create chances to rebalance, harvest tax losses, or reinvest in strong businesses at lower valuations. Reacting emotionally, on the other hand, often leads to poor timing and lasting damage to long-term returns. If your portfolio needs adjustments to better reflect your goals or risk tolerance, now is a sensible time to do so gradually and deliberately.

Despite the current turbulence, we remain constructive on the long-term outlook. Innovation, technological advancement, and productivity gains continue. Supply chains will adapt, and new trade alignments will eventually form. While short-term volatility may persist, history has shown that markets tend to reward patience, discipline, and resilience.

As always, we are closely monitoring the evolving landscape. Should conditions change materially, we are prepared to make tactical adjustments as needed—whether to manage risk or seize opportunity. We thank you for your continued trust, and we encourage you to reach out with any questions or to revisit your financial strategy with us. Times like these are when proactive communication and thoughtful planning matter most.

Joseph P. Biondo

CEO, CIO and Portfolio Manager

Sources: Index and sector returns – Nasdaq, MSCI, Sawgrass Asset Management; Tariffs – CNBC, NY Post, Visual Capitalist; Economic data and trends – Federal Reserve, US Bureau of Labor Statistics, BID Newsletter; Market outlook – CNBC, JP Morgan Asset Management

The information set forth regarding investments was obtained from sources that we believe reliable but we do not guarantee its accuracy or completeness. Neither the information nor opinion expressed constitutes a solicitation by us of the purchase or sale of any securities. Past performance does not guarantee future results.

First Quarter 2025 Market Commentary

Joseph P. Biondo

The first quarter of 2025 brought a surge in market volatility as new tariff announcements and renewed inflation risks disrupted what began as a cautiously optimistic year. US equity benchmarks posted their worst quarter since 2022 – the S&P 500 dropped 4.3%, the Nasdaq Composite tumbled 10.3% amid a tech selloff, and the Russell 2000 fell 9.5%. The Dow Jones Industrial Average held relatively flat, losing just 0.9%.

Sector performance diverged sharply – Energy gained 10.6%, Healthcare rose 5.6%, while Technology and Consumer Discretionary each plummeted over 13%. International markets held firmer: the MSCI ACWI ex-US Index climbed 5.2%, buoyed by a weaker dollar and stronger global demand. Meanwhile, bonds offered a defensive refuge, with the Bloomberg US Aggregate Bond Index rising 2.8% as investors rotated into high-quality fixed income amid rising uncertainty.

While inflation pressures and sectoral divergences shaped the broader Q1 downturn, the underlying driver of volatility—escalating trade tensions—accelerated meaningfully with the Trump administration’s tariff announcements in early April. On April 2, President Trump declared “Liberation Day,” introducing a 10% baseline tariff on all imports, effective April 5. Additionally, higher “reciprocal” tariffs were announced for 57 countries, based on trade deficits and perceived unfair practices.

These elevated tariffs were then suspended for 90 days for all countries except China, which now faces a cumulative tariff rate of 145% on its exports to the US. China responded by increasing tariffs on US goods to 125%, escalating the trade tensions. The situation has caused significant market volatility and uncertainty, with tech stocks experiencing sharp fluctuations due to temporary exemptions on certain electronics, such as smartphones and laptops. Commerce Secretary Howard Lutnick indicated that these exemptions are temporary and subject to change, adding to the uncertainty.

During the first quarter, inflation appeared to be moderating, giving hope that the Federal Reserve might begin easing later this year. But the new tariffs have altered the landscape. Headline CPI was relatively tame, and core inflation was trending down from its 2022 highs, but that has changed now. Analysts now expect the cost increases to reverse some of that progress, potentially adding 1-2 percentage points to inflation by year-end. Forward inflation expectations are rising across both consumer surveys and bond markets.

This development places the Fed in a precarious position. While policymakers had been signaling the possibility of rate cuts in late 2025, the inflationary jolt from tariffs may delay that path. The Fed held its benchmark rate steady at 4.25%–4.50% through Q1, and officials are now forced to balance the risk of economic slowing against the possibility of reaccelerating inflation. It’s unclear whether monetary policy alone can counteract tariff-driven price pressures, especially if global supply chains remain constrained.

Recession odds have risen accordingly. Though the US labor market remained solid in Q1—adding 228,000 jobs in March and keeping unemployment at 4.2%—consumer spending trends began to weaken. While January retail sales were strong, momentum faded through February and March. The personal savings rate rose to 4.6%, indicating that households are becoming more cautious. Discretionary spending categories like apparel, home goods, and dining saw softening. Big-ticket items—especially those requiring financing—have slowed as borrowing costs remain high and confidence wanes. Elevated interest rates, though justified as an inflation-fighting tool, continue to weigh on mortgage demand, auto loans, and consumer credit.

Corporations, particularly in import-heavy sectors like technology, apparel, and autos, are already signaling margin pressure. US automakers are grappling with rising component costs and inventory shortages, while manufacturers are stockpiling raw materials like copper and steel, driving up prices further. Oil markets reacted sharply on fears that tariffs would sap global demand. While lower energy prices could help consumers, they also threaten US shale producers, many of whom require higher breakeven prices to remain profitable.

Looking forward, several critical uncertainties will drive investor sentiment. Will trade negotiations cool tensions, or will retaliatory measures escalate? Can the Fed thread the needle between growth and inflation? Will consumers maintain spending momentum under rising price pressures? Until these questions gain clarity, markets are likely to remain volatile and reactive to incremental data releases and policy updates. The speculative excesses of 2023–2024 have largely been wrung out, with valuations in high-flying sectors like tech now returning to more grounded levels. This reset may eventually offer a firmer foundation for future gains—but for now, risk appetite remains muted, and markets are in “prove it” mode.

We continue to advocate for a balanced approach in portfolios. Diversification across asset classes and a focus on high-quality assets are critical in navigating an environment with rising macro risk and policy uncertainty. Maintaining flexibility and discipline will be key as opportunities and challenges evolve in real time.

Resisting the urge to sell during downturns is critical to long-term returns. Over the past 20 years, seven of the market’s 10 best days occurred within just two weeks of the 10 worst days. History shows that major rebounds often follow sharp pullbacks—a trend clearly visible during the Covid crisis in 2020 and relevant again today. For example, a $10,000 investment in the S&P 500 held from 2005 through 2024 would have grown to $71,750. However, missing just the 10 best days would cut that total by more than half to $32,871. Missing the 60 best days would yield a negative return, leaving the investor with less than they started with.

This underscores the cost of panic-selling. Volatility, while uncomfortable, often precedes recovery. Behavioral finance reminds us that investors are wired to flee from danger, yet the market has recovered from every major crisis—wars, recessions, pandemics—and eventually pushed to new highs. The S&P 500 recently hit 6,000 in late 2024, a reminder that long-term trends often reassert themselves despite near-term noise.

It is during periods like this—where uncertainty is high and headlines are alarming—that sticking to a thoughtful long-term financial plan becomes most important. Market pullbacks can create chances to rebalance, harvest tax losses, or reinvest in strong businesses at lower valuations. Reacting emotionally, on the other hand, often leads to poor timing and lasting damage to long-term returns. If your portfolio needs adjustments to better reflect your goals or risk tolerance, now is a sensible time to do so gradually and deliberately.

Despite the current turbulence, we remain constructive on the long-term outlook. Innovation, technological advancement, and productivity gains continue. Supply chains will adapt, and new trade alignments will eventually form. While short-term volatility may persist, history has shown that markets tend to reward patience, discipline, and resilience.

As always, we are closely monitoring the evolving landscape. Should conditions change materially, we are prepared to make tactical adjustments as needed—whether to manage risk or seize opportunity. We thank you for your continued trust, and we encourage you to reach out with any questions or to revisit your financial strategy with us. Times like these are when proactive communication and thoughtful planning matter most.

Joseph P. Biondo

CEO, CIO and Portfolio Manager

Sources: Index and sector returns – Nasdaq, MSCI, Sawgrass Asset Management; Tariffs – CNBC, NY Post, Visual Capitalist; Economic data and trends – Federal Reserve, US Bureau of Labor Statistics, BID Newsletter; Market outlook – CNBC, JP Morgan Asset Management

The information set forth regarding investments was obtained from sources that we believe reliable but we do not guarantee its accuracy or completeness. Neither the information nor opinion expressed constitutes a solicitation by us of the purchase or sale of any securities. Past performance does not guarantee future results.