While global markets showed strong signs of life during the third quarter of 2022, the results were largely the same as the first half of the year – negative. From the lows in June through mid-August, the S&P 500 Index rallied nearly 17%. Hawkish comments from the Federal Reserve Chairman Jerome Powell, at the Jackson Hole Summit in August, ended that rally dead in its tracks – all gains had evaporated by the end of the quarter. For the full third quarter ended September 30, 2022, the S&P 500 Index was down -4.9%, leaving the year-to-date performance of -23.9%. Other US Equity Indexes had similar results in the quarter and year-to-date periods, with the Nasdaq Composite down -3.9% and -32.0%, while the Dow Jones Industrial Average declined by -6.2% and -19.7%, respectively. Complicating the picture for investors, even broad measures of bonds – typically a safe haven – traded poorly, with the US Core Bond Index as tracked by Morningstar declining by -4.8% for the quarter, and -14.6% in the year-to-date period.

Some elements of this year’s story have changed; however, the central theme remains largely the same – inflation. Inflation has many components, but one is an imbalance between supply and demand. The Federal Reserve cannot affect the supply side of the markets for goods and services, but through increasing interest rates, it can have a profound impact on the demand side. While market participants were hopeful over the summer, Powell’s comments in August quickly dashed them. Specifically, Powell said that the Fed’s interest rate moves will bring “some pain to households and businesses.” The data continued to suggest Powell’s comments were warranted, as the Consumer Price Index (CPI) rose 9.1% year over year through June, and despite some recent easing, inflation remains stubbornly high. It is important to remember that this is not just a US issue, as inflation has manifested in large economies across the globe. Consumers and businesses worldwide have not experienced inflation in many years, and the impact of persistent inflation on the economy is key to why the Federal Reserve is going to great lengths to get prices under control.

Some elements of this year’s story have changed; however, the central theme remains largely the same – inflation. Inflation has many components, but one is an imbalance between supply and demand. The Federal Reserve cannot affect the supply side of the markets for goods and services, but through increasing interest rates, it can have a profound impact on the demand side. While market participants were hopeful over the summer, Powell’s comments in August quickly dashed them. Specifically, Powell said that the Fed’s interest rate moves will bring “some pain to households and businesses.” The data continued to suggest Powell’s comments were warranted, as the Consumer Price Index (CPI) rose 9.1% year over year through June, and despite some recent easing, inflation remains stubbornly high. It is important to remember that this is not just a US issue, as inflation has manifested in large economies across the globe. Consumers and businesses worldwide have not experienced inflation in many years, and the impact of persistent inflation on the economy is key to why the Federal Reserve is going to great lengths to get prices under control.

The steepness of this cycle’s rate hikes, and the Federal Reserve’s renewed commitment to maintain this trajectory, has been a hot topic of discussion from both an investor and economist point of view. I recently had the opportunity to provide commentary for a Nasdaq Trade Talks article that highlights our perspective and outlook to date.

How are you evaluating the recent fed rate hikes? How do you think the markets will react to further rate hikes?

When it comes to the Fed, it’s important to keep some perspective and look at where we’re coming from as we try to evaluate the current and the future markets. Coming out of the global recession in 2008-2009, the Federal Reserve kept interest rates at the zero bound for a very long time, which took a toll on investors and economies.

If you look back to late 2018 and into 2019, the Fed actually began a cycle of becoming less accommodative, reducing stimulus so the economy could stand on its own. Then Covid hit and the Fed quickly reversed their position, literally printing and giving people money to offset the uncertainty from shutdowns and supply chain shortages. In my view, they handled it very appropriately as the economy held up pretty well. The economy actually grew, and it kept the stock market strong.

Fast forward to 2022, and the Fed is faced with an imbalance of high demand with supply chain shortages and inflation. They’ve raised interest rates fairly aggressively to 3-3.25%, and it looks like futures markets are predicting over the next couple of years that the Fed funds rate will be at 4-4.5%. I feel it’s appropriate to reduce some of the stimulus even though the markets, coming off the highs of previous years, are feeling the pain.

We probably underestimated the magnitude of the decline in the first six months, but our expectation is still that in the back half of the year, we expect things to improve.

Is the worst of the stock market behind us? And when do you expect the recovery?

We do think the worst of it is behind us. The biggest impact I see from a market perspective or from an economic perspective of a recession is people generally fear they will lose their jobs, which impacts their spending, then the economy, and that has an impact on the stock market. Usually, the markets bottom well before the recession is declared. The employment picture remains strong, so the typical fear won’t have as large an impact this time.

We look for signs all the time from a market perspective. We pay a lot of attention to technical analysis, and we’re seeing some positive divergences in the overall health of the market. That gives us a good dose of optimism — that we’re in a major bottoming process now and that there’s probably better times ahead.

That doesn’t mean that we’re completely out of the woods; that it’s all smooth sailing from here. There’s fits and starts. In July and August, the markets recovered, had a little bit of a rally, and then September kind of took it all away. But I’m seeing things that are very encouraging from a market perspective. While price hasn’t improved, the internal technical indicators that we pay attention to have improved pretty dramatically. It is also important to remember that bottoming is a process and not an event, and over the long-term, investing when others are fearful can be quite rewarding.

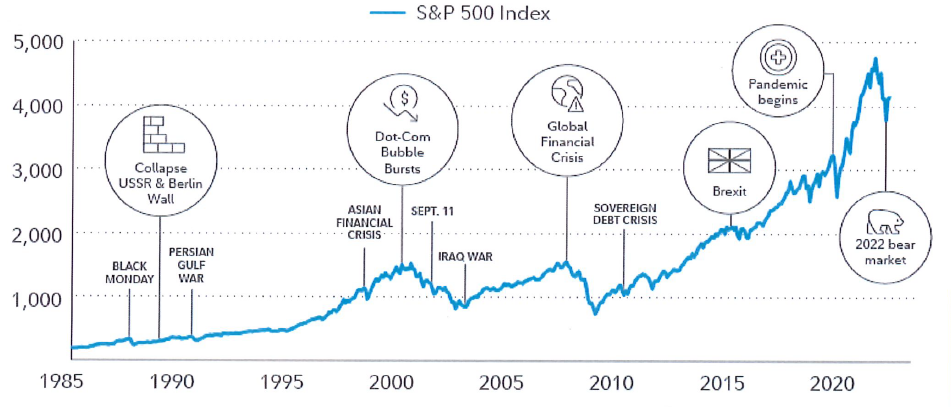

While it never feels good or “normal” when markets are down, it is healthy to understand that downturns do occur and are a given in the course of an investor’s timeline. On average since 1926, stocks have dipped into bear market territory every 6 years with losses averaging almost 40%. While market downturns may be unsettling, history shows stocks have recovered and delivered long-term gains. As can be seen in the chart below – long term investors have been rewarded for patience despite the many “crisis” periods that occur. While the downturns can be severe, over the course of time they appear mild with the proper lens. In our view, this time will be no different.

Are there any economic indicators that investors should be paying close attention to during this period?

In the beginning of the fourth quarter, companies will start reporting quarterly earnings. They will tell you how business was the last few months of the year, but also how they think things will go for the rest of the year and start to talk about how they see next year unfolding.

Other indicators that people can pay attention to is car manufacturers’ reports and oil and gas prices, which may highlight the supply and demand imbalance. The quantity of new mortgage applications will show how rate hikes have impacted the housing market. Of course, any improvement in inflation will have positive market impact.

Despite market pullbacks, stocks have risen over the long term.

Source: Fidelity Investments. Past performance is no guarantee of future results.

Source: Fidelity Investments. Past performance is no guarantee of future results.

How might investors position their portfolios for that current environment that we see today?

We think the biggest opportunities lie in the most economically sensitive companies, typically the riskiest parts of the market. Growth stocks, for example, which, 3, 6, 9, 12 months ago were anywhere from 40 to 80% higher than they are today. We’ve seen a big reduction in prices, and a much more attractive valuation today based on earnings, than they were at any point in the last year.

We’re seeing these positive divergences in things like technology, industrials and financials. Companies that are usually very economically sensitive are displaying very strong relative strength and money flow. We’re positioning portfolios to take advantage of the things that have been hit the hardest. It’s always important to us to look for great companies run by smart people with attractive valuations.

From a positioning standpoint, if you were positioned defensively enough over the past year, it might be time to start poking your head out of the shell a little bit. If you’re heavy on cash or bonds, perhaps move towards buying some good quality companies that have been beaten down in price.

If you have a time horizon of three to five years or beyond, it could be a good time to be taking on a little bit more risk in your portfolio. It’s different for each individual’s situation, but that’s where we’re looking to guide clients.

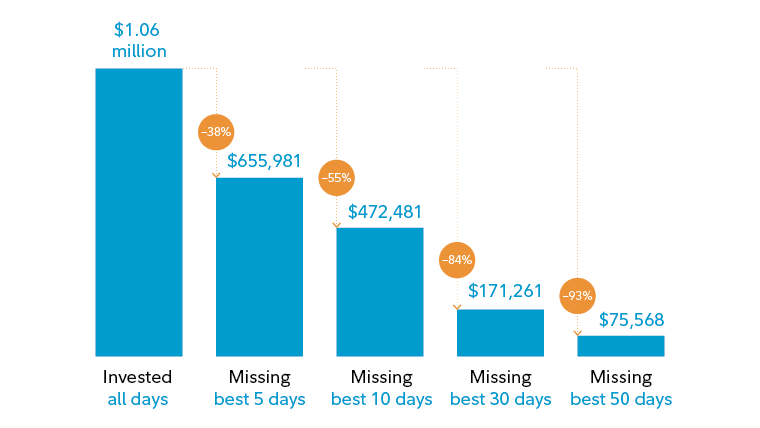

It can be tempting to try to sell out of stocks to avoid downturns, but it’s hard to time it right. If you sell and are still on the sidelines during a recovery, it can be difficult to catch up. The chart below demonstrates that missing even a few of the best days in the market can significantly impact your performance.

Focus on time in the market – not trying to time the market.

Hypothetical growth of $10,000 invested in the S&P 500 Index

January 1, 1980 – June 30, 2022

Sources: FMRCo, Asset Allocation Research Team, as of June 30, 2022. Past performance is no guarantee of future results.

As the chart demonstrates, market timing proves futile. To put the above in perspective – the chart represents 42.5 years’ worth of data, and missing slightly more than 1 day per year over that period yields dramatically worse results. To time the market, investors need to be right twice – and very accurate at that. We instead focus on investing in great businesses and owning them for long periods of time.

Given the current backdrop, with global markets in turmoil and the sense of uncertainty that accompanies such times, there is no better time to review your goals, revisit your future expectations and evaluate your overall asset allocation and risk tolerance. Clients that have taken advantage of WealthMap – our financial planning platform, and Riskalyze – our platform for aligning your risk tolerance to the proper investment portfolios, have gained confidence. I strongly encourage you to take advantage of all the capabilities that our firm brings to bear, which will help you to live with increased financial confidence.

As always, we remain committed to adjusting to an ever-changing landscape, performing sound research and exercising common sense. This involves not only individual security selection, but asset allocation and risk management decisions with the goal of meeting your individual investment needs. Please feel free to reach out to us to review your personal situation so we can ensure that we have built your portfolio to accommodate your various needs, and also address any concerns that you may have. We appreciate the opportunity to serve you and appreciate the trust and confidence that you have placed in our firm.

Joseph P. Biondo

CEO, CIO, Portfolio Manager

Sources: Index returns – Bloomberg; Morningstar; Powell quote – CNN Business; CPI-Nasdaq; Bear markets, charts – Fidelity

The information set forth regarding investments was obtained from sources that we believe reliable but we do not guarantee its accuracy or completeness. Neither the information nor opinion expressed constitutes a solicitation by us of the purchase or sale of any securities. Past performance does not guarantee future results.

Third Quarter Market Commentary

Joseph P. Biondo

While global markets showed strong signs of life during the third quarter of 2022, the results were largely the same as the first half of the year – negative. From the lows in June through mid-August, the S&P 500 Index rallied nearly 17%. Hawkish comments from the Federal Reserve Chairman Jerome Powell, at the Jackson Hole Summit in August, ended that rally dead in its tracks – all gains had evaporated by the end of the quarter. For the full third quarter ended September 30, 2022, the S&P 500 Index was down -4.9%, leaving the year-to-date performance of -23.9%. Other US Equity Indexes had similar results in the quarter and year-to-date periods, with the Nasdaq Composite down -3.9% and -32.0%, while the Dow Jones Industrial Average declined by -6.2% and -19.7%, respectively. Complicating the picture for investors, even broad measures of bonds – typically a safe haven – traded poorly, with the US Core Bond Index as tracked by Morningstar declining by -4.8% for the quarter, and -14.6% in the year-to-date period.

The steepness of this cycle’s rate hikes, and the Federal Reserve’s renewed commitment to maintain this trajectory, has been a hot topic of discussion from both an investor and economist point of view. I recently had the opportunity to provide commentary for a Nasdaq Trade Talks article that highlights our perspective and outlook to date.

How are you evaluating the recent fed rate hikes? How do you think the markets will react to further rate hikes?

When it comes to the Fed, it’s important to keep some perspective and look at where we’re coming from as we try to evaluate the current and the future markets. Coming out of the global recession in 2008-2009, the Federal Reserve kept interest rates at the zero bound for a very long time, which took a toll on investors and economies.

If you look back to late 2018 and into 2019, the Fed actually began a cycle of becoming less accommodative, reducing stimulus so the economy could stand on its own. Then Covid hit and the Fed quickly reversed their position, literally printing and giving people money to offset the uncertainty from shutdowns and supply chain shortages. In my view, they handled it very appropriately as the economy held up pretty well. The economy actually grew, and it kept the stock market strong.

Fast forward to 2022, and the Fed is faced with an imbalance of high demand with supply chain shortages and inflation. They’ve raised interest rates fairly aggressively to 3-3.25%, and it looks like futures markets are predicting over the next couple of years that the Fed funds rate will be at 4-4.5%. I feel it’s appropriate to reduce some of the stimulus even though the markets, coming off the highs of previous years, are feeling the pain.

We probably underestimated the magnitude of the decline in the first six months, but our expectation is still that in the back half of the year, we expect things to improve.

Is the worst of the stock market behind us? And when do you expect the recovery?

We do think the worst of it is behind us. The biggest impact I see from a market perspective or from an economic perspective of a recession is people generally fear they will lose their jobs, which impacts their spending, then the economy, and that has an impact on the stock market. Usually, the markets bottom well before the recession is declared. The employment picture remains strong, so the typical fear won’t have as large an impact this time.

We look for signs all the time from a market perspective. We pay a lot of attention to technical analysis, and we’re seeing some positive divergences in the overall health of the market. That gives us a good dose of optimism — that we’re in a major bottoming process now and that there’s probably better times ahead.

That doesn’t mean that we’re completely out of the woods; that it’s all smooth sailing from here. There’s fits and starts. In July and August, the markets recovered, had a little bit of a rally, and then September kind of took it all away. But I’m seeing things that are very encouraging from a market perspective. While price hasn’t improved, the internal technical indicators that we pay attention to have improved pretty dramatically. It is also important to remember that bottoming is a process and not an event, and over the long-term, investing when others are fearful can be quite rewarding.

While it never feels good or “normal” when markets are down, it is healthy to understand that downturns do occur and are a given in the course of an investor’s timeline. On average since 1926, stocks have dipped into bear market territory every 6 years with losses averaging almost 40%. While market downturns may be unsettling, history shows stocks have recovered and delivered long-term gains. As can be seen in the chart below – long term investors have been rewarded for patience despite the many “crisis” periods that occur. While the downturns can be severe, over the course of time they appear mild with the proper lens. In our view, this time will be no different.

Are there any economic indicators that investors should be paying close attention to during this period?

In the beginning of the fourth quarter, companies will start reporting quarterly earnings. They will tell you how business was the last few months of the year, but also how they think things will go for the rest of the year and start to talk about how they see next year unfolding.

Other indicators that people can pay attention to is car manufacturers’ reports and oil and gas prices, which may highlight the supply and demand imbalance. The quantity of new mortgage applications will show how rate hikes have impacted the housing market. Of course, any improvement in inflation will have positive market impact.

Despite market pullbacks, stocks have risen over the long term.

How might investors position their portfolios for that current environment that we see today?

We think the biggest opportunities lie in the most economically sensitive companies, typically the riskiest parts of the market. Growth stocks, for example, which, 3, 6, 9, 12 months ago were anywhere from 40 to 80% higher than they are today. We’ve seen a big reduction in prices, and a much more attractive valuation today based on earnings, than they were at any point in the last year.

We’re seeing these positive divergences in things like technology, industrials and financials. Companies that are usually very economically sensitive are displaying very strong relative strength and money flow. We’re positioning portfolios to take advantage of the things that have been hit the hardest. It’s always important to us to look for great companies run by smart people with attractive valuations.

From a positioning standpoint, if you were positioned defensively enough over the past year, it might be time to start poking your head out of the shell a little bit. If you’re heavy on cash or bonds, perhaps move towards buying some good quality companies that have been beaten down in price.

If you have a time horizon of three to five years or beyond, it could be a good time to be taking on a little bit more risk in your portfolio. It’s different for each individual’s situation, but that’s where we’re looking to guide clients.

It can be tempting to try to sell out of stocks to avoid downturns, but it’s hard to time it right. If you sell and are still on the sidelines during a recovery, it can be difficult to catch up. The chart below demonstrates that missing even a few of the best days in the market can significantly impact your performance.

Focus on time in the market – not trying to time the market.

Hypothetical growth of $10,000 invested in the S&P 500 Index

January 1, 1980 – June 30, 2022

Sources: FMRCo, Asset Allocation Research Team, as of June 30, 2022. Past performance is no guarantee of future results.

As the chart demonstrates, market timing proves futile. To put the above in perspective – the chart represents 42.5 years’ worth of data, and missing slightly more than 1 day per year over that period yields dramatically worse results. To time the market, investors need to be right twice – and very accurate at that. We instead focus on investing in great businesses and owning them for long periods of time.

Given the current backdrop, with global markets in turmoil and the sense of uncertainty that accompanies such times, there is no better time to review your goals, revisit your future expectations and evaluate your overall asset allocation and risk tolerance. Clients that have taken advantage of WealthMap – our financial planning platform, and Riskalyze – our platform for aligning your risk tolerance to the proper investment portfolios, have gained confidence. I strongly encourage you to take advantage of all the capabilities that our firm brings to bear, which will help you to live with increased financial confidence.

As always, we remain committed to adjusting to an ever-changing landscape, performing sound research and exercising common sense. This involves not only individual security selection, but asset allocation and risk management decisions with the goal of meeting your individual investment needs. Please feel free to reach out to us to review your personal situation so we can ensure that we have built your portfolio to accommodate your various needs, and also address any concerns that you may have. We appreciate the opportunity to serve you and appreciate the trust and confidence that you have placed in our firm.

Joseph P. Biondo

CEO, CIO, Portfolio Manager

Sources: Index returns – Bloomberg; Morningstar; Powell quote – CNN Business; CPI-Nasdaq; Bear markets, charts – Fidelity

The information set forth regarding investments was obtained from sources that we believe reliable but we do not guarantee its accuracy or completeness. Neither the information nor opinion expressed constitutes a solicitation by us of the purchase or sale of any securities. Past performance does not guarantee future results.